What Is a Kid Agains Budget

11 Min Read | April 14, 2022

If you're ready to get your family unit's coin managed once and for all, nosotros've got adept news—we know exactly where to offset.

Budget.

Information technology'south a unproblematic word, but information technology doesn't always seem simple to put into practice—especially when you've got kids. You're decorated, your money'southward tight, and money talks are sometimes super awkward.

But you can create a family budget, no thing your fourth dimension, income or emotional reservations. We're here to reply some questions and give you our best tips and tricks to do merely that.

What Is a Family Upkeep?

Why Should Yous Have a Family unit Budget?

How to Set Up Your Family Budget in 3 Steps

Tips for Creating a Family Budget That Works (for Everyone)

What Is a Family Budget?

Earlier we evidence y'all how to budget, permit's define the term. A budget is just a plan for your money—everything that comes in (income) and goes out (expenses).

A family budget is when you make that programme for your whole household. And the all-time family unit budgets include everyone in the family unit (at least to some caste).

Why Should You Have a Family Budget?

Budgeting as a family unit has many perks. Here are three of our favorites: one) You lot'll stop wondering where your coin went and start telling it where to go. 2) You lot can first getting everyone on the same page about coin. iii) You'll testify that money isn't a taboo topic as you open up lines of advice.

How to Set Your Family Budget in 3 Steps

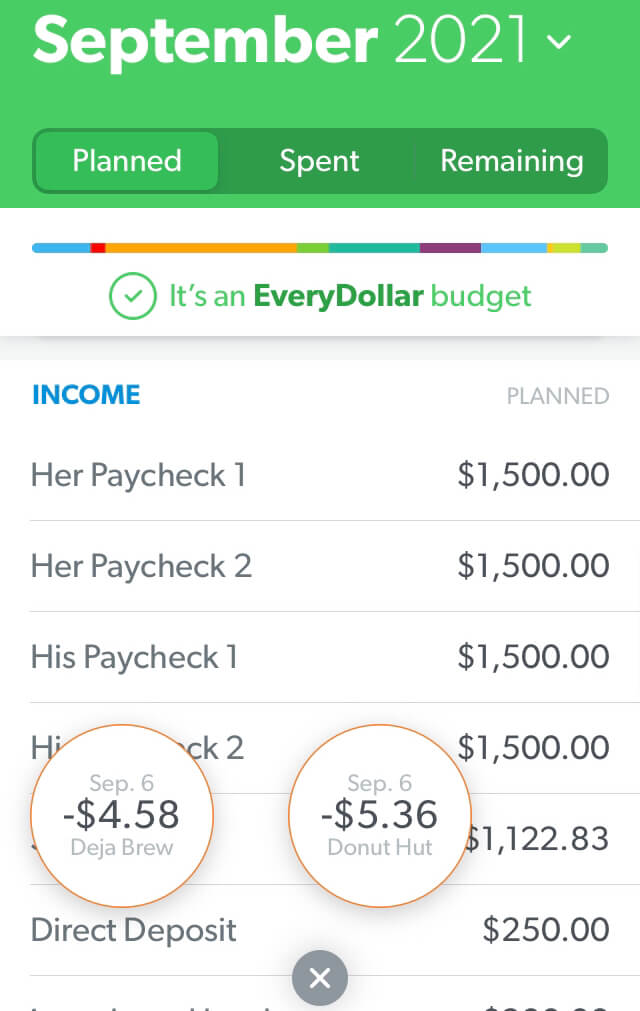

Budget Step 1: Listing your income.

The beginning step here is listing your income—aka any money you plan to go during that month.

Showtime budgeting with EveryDollar today!

Write down each normal paycheck for you and your spouse—and don't forget any actress money coming your way through a side hustle, garage sale, freelance work, or anything like that.

If you've got an irregular income, put the everyman estimate of what you normally make in this spot. (You lot can adjust later in the month if you make more.)

Budget Step 2: List your expenses.

Now that y'all've planned for the money coming in, you can programme for the coin going out. It's time to list your expenses! (Pro tip: Open up your online bank business relationship or expect at your banking company statement to assist you estimate your expenses.)

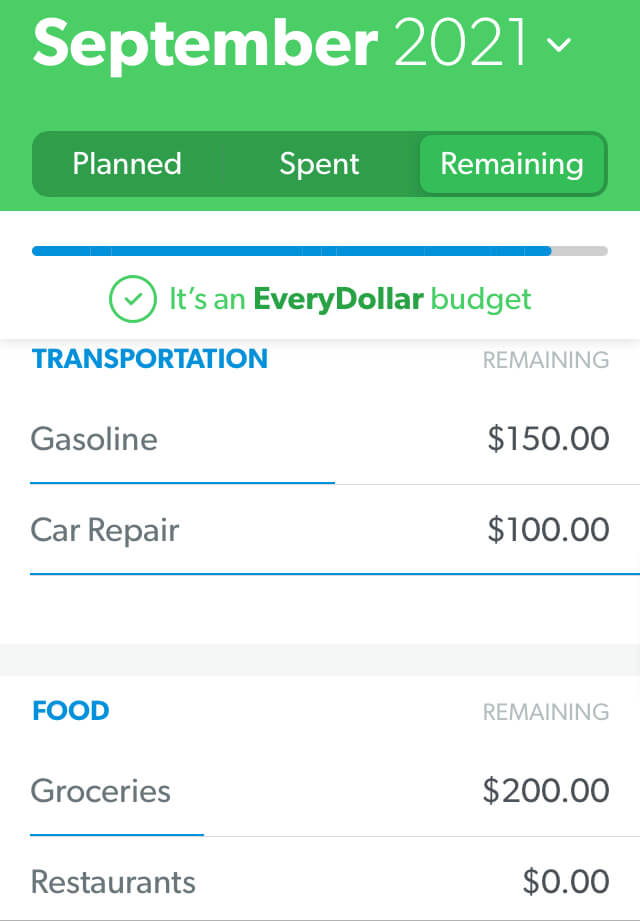

Kickoff by covering your 4 Walls—aka food, utilities, shelter and transportation.

Some of these are called stock-still expenses, meaning they stay the same every month (similar your mortgage or rent). Others change up, like groceries.

And hey, that grocery budget line is pretty hard to guess at commencement. Just make a really skillful estimate, and you'll learn what you lot actually need hither in the month ahead.

Next, listing all other monthly expenses. Nosotros're talking nearly insurance, debt, savings, entertainment and any personal spending. Beginning with fixed expenses. Then employ your online bank account or those bank statements to estimate planned amounts for everything else based on your spending in the past months.

Budget Pace 3: Decrease your income from your expenses.

When you decrease your income from your expenses, it should equal zero. That doesn't mean your bank account is at zip: It means every bit of your income has a task. (This is called a nothing-based budget.)

If you accept coin left over after you lot've subtracted all your expenses, be sure to put it in the budget too! Otherwise, you'll end up mindlessly spending it on coffees and those one-click deals of the twenty-four hours. Really. Put annihilation "extra" toward your current money goal, like saving or paying off debt.

What if you end upwardly with a negative number? You might exist thinking, Yikes! Simply it'south really okay! Yous just need to cutting expenses until your income minus your expenses equals zero. Hint: Start with those restaurant and entertainment lines. (Yes, we went there.) Because hey—you can't spend more than than you make. You lot got this!

Recollect, you piece of work hard for your coin. It should work hard for you. Every. Single. Dollar.

Tips for Creating a Family Budget That Works (for Everyone)

i. Select a budgeting method.

You need to option a budgeting method. Whether it's a spreadsheet, pencil and paper, or an app . . . pick a way to log your income, expenses and spending. Every. Unmarried. Calendar month.

Whatever method you pick needs to see a few requirements. It should be:

- Easy for both spouses to access

- Uncomplicated to create new monthly budgets

- Convenient to rail spending throughout the month

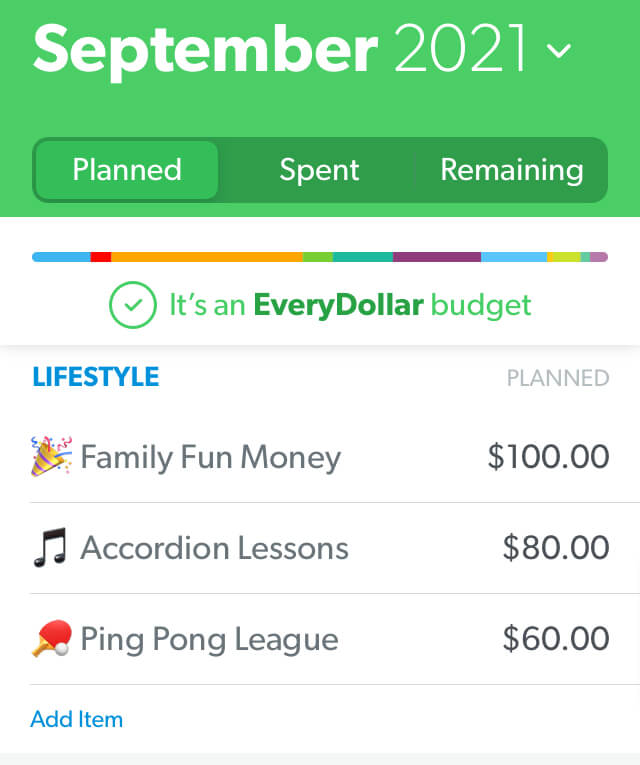

May we suggest our favorite budgeting tool, EveryDollar? It meets all those requirements . . . and and then some.

With EveryDollar, you can budget on your desktop or in the app. That means both spouses can log in to the same budget on their dissever phones, checking in to see how much is left in a particular budget line or tracking their spending on the go. This creates accountability—which is cardinal in a successful family unit upkeep.

Oh, and making new monthly budgets takes merely a couple minutes. An EveryDollar budget is a time and advice saver.

2. Talk near where you are right at present.

Yous tin can figure out merely how much you want to share with your kids based on their age and your comfort level. Perhaps you don't want to spell out how much coin yous make or the verbal amount of every bill. But do have an honest family conversation near how things are with finances in your household. Right at present.

Later that, you can talk about where y'all're going and how to get there—as a squad. Go on these lines of advice open and make talking virtually money experience normal. Information technology might be a bit uncomfortable at get-go, merely yous'll get the hang of it!

3. Hash out the divergence in wants and needs.

For whatever family unit budget to succeed, yous need to explicate to children (and maybe remind yourself?) the deviation betwixt wants and needs—and how important information technology is to encounter needs kickoff. This means you're budgeting for those Iv Walls (which nosotros mentioned earlier) earlier family unit memberships to the local wax museum.

4. Communicate with your kids to prioritize spending that connects to them.

You probably don't have enough money in the budget for your kids to be involved in everything they're interested in. And that's okay.

When it comes to extracurriculars, clubs, sports, lessons and the like—talk to your kids virtually how these all cost money. One affair per kid per season is plenty fortheir time and your budget. Work together to effigy out what that one thing should be.

And when you put information technology all in the budget, be sure to include a family unit fun budget line (if you've got money to cover it).

5. Create money goals together.

Offset making money goals together. These goals can connect to paying off debt or saving money (as in saving upward for emergencies, a big purchase, or a fun family experience).

Talk through how everyone can be involved in making these goals come truthful. Ways to exercise that are coming in hot with this next tip.

6. Track your goal progress.

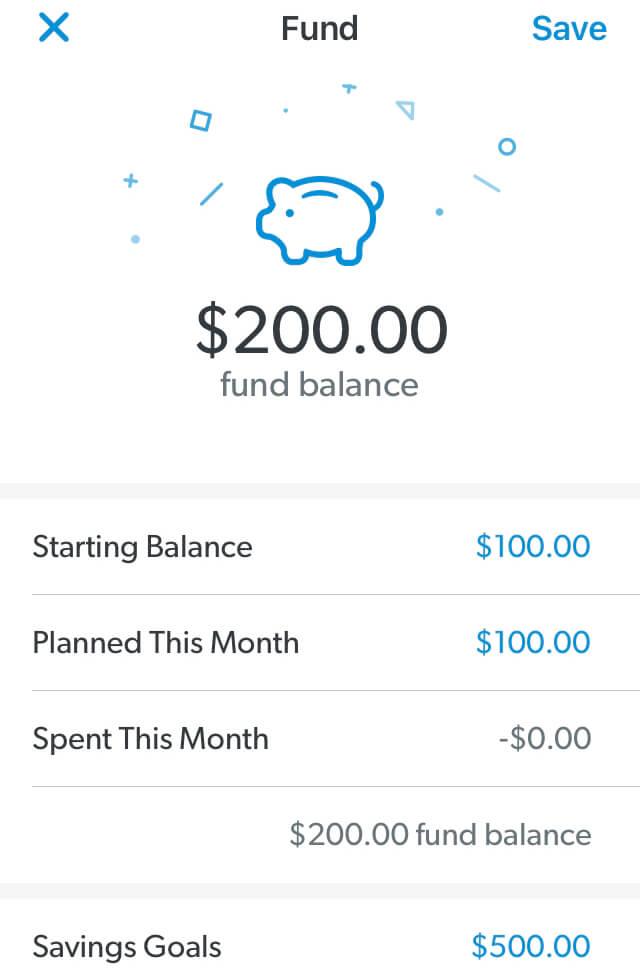

Let's say you're saving upwards for a family vacation. Set a savings target for this coin goal—and track your progress equally a family.

If y'all're using EveryDollar, you tin can set a sinking fund for your goal and picket it make full along the way.

Want to get to the goal faster? Accept a family planning meeting to brainstorm ways to make it happen. Determine to tighten or cut spending by going without some extras for a couple months. Take on side jobs (some you tin even do from home). Fifty-fifty the kids can do a bake sale or mow some lawns to aid the family goals happen sooner.

Including the kids hither shows them how finances piece of work—and how what they do impacts the family in multiple means. Life lessons all around.

seven. Take monthly budget meetings.

Monthly budget meetings are one of the best means to keep those open lines of communication about coin going throughout the year. Here's what you should recall about before and during those meetings.

Each calendar month comes with the standard stuff you lot spend money on—also as month-specific expenses. Program family budget meetings to talk about those irresolute expenses for sure. Also, get over where you lot struggled final month, celebrate your budgeting victories, and check in on your goals.

Brand sure the meetings don't run too long. You don't desire budgets to announced boring—considering they aren't! And it'southward always in your best interest to have snacks. Always.

eight. Brand paying off debt a priority.

$14.64 trillion. That's the full household debt in America as of the get-go of 2021.ane No. Joke.

Debt is constantly knocking on our forepart doors similar a sneaky salesman with tempting "rewards" and the hope of instant gratification. But actually, all debt does is concord your income hostage to pay for your by.

Well, information technology's fourth dimension to slam the door in debt's lying face. No more being a part of that $14.64 trillion statistic.

The best manner to get out of debt is to get anybody in the house on board—make paying off debt a priority. Talk it up. Become hyped. Create a playlist and have a dance political party every time you make more than a minimum payment. Learn most the debt snowball method, and utilise it to take dorsum your income. All. Of. Information technology.

You've got to stay motivated through budgeting and paying off your debt. You've got to find ways to celebrate the victories (big and small). And you've got to do it together—every bit a team!

9. Track your spending throughout the month.

We mentioned how tracking your spending throughout the month creates communication and accountability with your spouse. But guess what. It also makes y'all accountable to yourself.

Yup. Sometimes you lot're the exact person who needs to look at that restaurant budget line and see information technology's simply too low to hit up the Fry Guys nutrient truck for luncheon with your coworkers.

Merely tracking spending shouldn't get the reputation of existence a killjoy. Yes, it'southward existence responsible. Merely people who are responsible with their money are people who have command of their money—instead of the other way around. People who are responsible with their money don't wonder where information technology all went at the end of the month. It'southward totally worth it!

If y'all don't want your money owning your family and holding yous dorsum from your goals, and then scout your spending. Track your expenses.

Too, look how like shooting fish in a barrel information technology is to track transactions with the premium version of EveryDollar (available merely in Ramsey+). You can connect your budget to your banking concern so transactions stream right in. Grabbed a sweetness treat at Donut Hut? Drag and driblet the buy to the correct budget line. It's the best life for busy budgeters.

10. Adjust your budget when needed.

Braces, bow ties and budgets. What do these three B-words have in common? They all need adjusting.

Yes, you're supposed to adjust your budget during the month. As you're tracking those transactions and a budget line is getting close to maxing out, you take two options. Ane: Only say no. 2: Move things effectually.

The offset selection is always your answer for the extras in life. When your personal spending line is gone, it's gone. When the restaurant budget line is spent, information technology'southward spent.

But let's say your electricity bill was higher than you planned. You can't call the electrical company to explain your upkeep line and ask them to take dorsum some of the lights y'all left on last month. Nope. You pay the bill. And you find that money past adjusting a dissimilar budget line.

A budget isn't a dull cooker. Yous tin can't set it and forget information technology. You've got to make it at that place and make adjustments so your budget works for you and your family unit.

11. Have the kids piece of work on commission.

Lots of us got an assart growing upwardly. Only having your kids piece of work for a committee instead of handing them money for naught teaches them how the world of piece of work runs. They do chores—they become paid. They save their money—they pay for things.

First kids out on commission-based earning so they acquire the value of money, hard work, and how those two things are directly connected.

12. Don't be agape to talk most money.

If this all seems bad-mannered at first, that'due south normal. Turns out only 28% of parents are talking to their kids nearly money.2 That's not skilful enough!

Push past the clumsiness that might be holding you back. Budgeting together and teaching your kids how to brand and spend money wisely—these are two of the all-time fiscal foundations you can create for your kids to aid them win with money subsequently in life.

You know what they say: The family that budgets together, grows together. (Okay, maybe we're the but ones who say that. But it's true.)

Hey, nosotros've said it before, and we'll say it again. We honey budgets. We made EveryDollar because nosotros desire you lot to love budgets too—or at least realize they aren't hard or bad or a ton of work.

Become started with EveryDollar today, as a family. And bring snacks.

Nearly the author

Ramsey Solutions

Source: https://www.ramseysolutions.com/budgeting/how-to-create-a-family-budget

0 Response to "What Is a Kid Agains Budget"

Post a Comment